Client Types:

Fintech Startup (Landed, Series B) · Nonprofit CBO (MEDA)

Scope of Work:

Financial Advising · Homeownership Coaching · CRM & Sales Ops · Community Partnerships · Housing Access Navigation

Context & Challenge

Building wealth in historically excluded communities isn’t just about having the right product—it’s about trust, timing, and tools that reflect people’s lived experiences. Across both fintech and nonprofit roles, I supported first-time homebuyers, immigrant families, and small business owners by offering financial advising and coaching rooted in equity and cultural fluency.

My Role

Financial Advisor · Regional Program Manager · Community Wealth-Building Coach

- At Landed, a Series B fintech company helping educators access homeownership:

- Managed a regional pipeline of over 3,000 customers using HubSpot

- Provided direct financial advising to educators and school staff, helping them understand down payments, equity shares, and mortgage options

- Closed $600K in shared equity product sales, supporting $4M+ in homebuying transactions

- Ran lead generation and segmentation experiments, improving sales conversion and outreach efficiency

- Facilitated in-person and virtual financial literacy workshops at school districts

- Forged partnerships with 5 new community-based organizations (CBOs), including school unions and housing counseling agencies

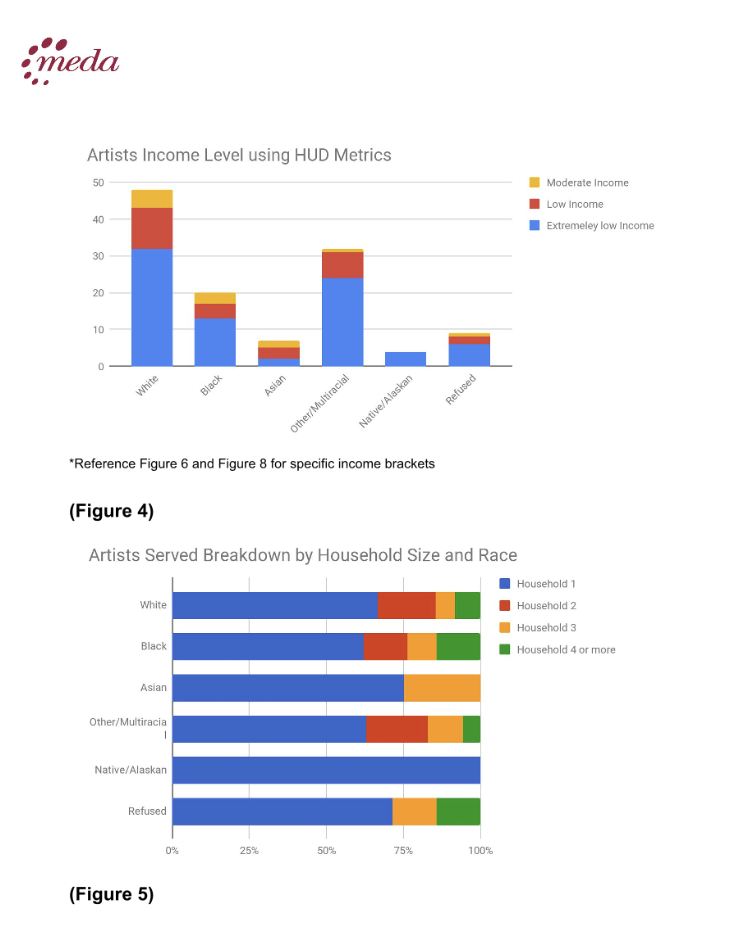

- At Mission Economic Development Agency (MEDA):

- Delivered financial advising and small business coaching to over 300 Latine and immigrant entrepreneurs in San Francisco’s Mission District

- Supported working-class families, including educators, in navigating Below Market Rate (BMR) and Downpayment Assistance Loan Program (DALP) housing processes

- Guided clients through long-term financial planning, credit readiness, and public program eligibility

- Forged partnerships with 20 new community-based organizations (CBOs), including small businesses, art spaces and housing agencies

- Helped DJ Lamont, a longtime community figure, open his first commercial studio through the Small Sites Program, supporting permitting, financing strategy, and launch logistics

- Created Salesforce reports to track outcomes, programming opportunities, contact lists and engagement metrics

Tools & Strategies Used

| Tool / Platform | Function |

|---|---|

| HubSpot & Salesforce CRM | Customer pipeline tracking, outreach segmentation, and follow-up |

| Financial Literacy Tools | Advising on credit, home affordability, shared equity, and capital access |

| Public Program Navigation | Navigating BMR, DALP, and Small Sites programs |

| Strategic Community Partnerships | CBO engagement, referral networks, and trust-building |

Outcomes & Impact

| Milestone | Result |

|---|---|

| 3,000+ leads managed via CRM systems | Increased customer clarity, segmentation, and trust-based follow-up |

| $600K+ in shared equity product sales | Over $4M in educator home purchases supported |

| Financial advising + education | Delivered to hundreds of first-time buyers, especially educators |

| 25 new CBO partnerships | Broadened reach and localized engagement channels |

| 300+ entrepreneurs & prospective homebuyer’s coached | Supported educators, artist, city-workers, and mixed-income households to secure financing options for homeownership or small business capital |

| Cultural anchor preserved | Helped community DJ secure commercial studio space in Mission District |

Why It Matters

Financial tools can either reinforce exclusion—or unlock possibility. Through hands-on advising, systems design, and culturally responsive coaching, I helped individuals and families build paths to ownership and economic stability. Whether it’s guiding a teacher through their first home purchase or helping an entrepreneur keep their doors open, I focus on building infrastructure that honors both the numbers and the people behind them.